All Categories

Featured

Table of Contents

Insurance provider will not pay a small. Instead, consider leaving the cash to an estate or trust fund. For even more thorough information on life insurance policy get a copy of the NAIC Life Insurance Policy Buyers Overview.

The internal revenue service puts a limit on just how much money can enter into life insurance policy premiums for the policy and how quickly such costs can be paid in order for the policy to maintain all of its tax obligation benefits. If particular limits are gone beyond, a MEC results. MEC insurance holders might undergo taxes on distributions on an income-first basis, that is, to the extent there is gain in their policies, along with fines on any type of taxed amount if they are not age 59 1/2 or older.

Please note that exceptional lendings build up rate of interest. Income tax-free treatment also thinks the loan will become pleased from income tax-free fatality advantage earnings. Financings and withdrawals decrease the policy's money value and death advantage, might cause specific policy advantages or riders to end up being unavailable and might boost the chance the plan may lapse.

A customer might qualify for the life insurance coverage, but not the biker. A variable global life insurance coverage contract is a contract with the primary purpose of supplying a death benefit.

What types of Policyholders are available?

These profiles are closely taken care of in order to satisfy stated financial investment purposes. There are charges and charges connected with variable life insurance policy contracts, including death and risk fees, a front-end tons, management fees, financial investment monitoring charges, surrender charges and charges for optional motorcyclists. Equitable Financial and its associates do not supply legal or tax obligation guidance.

And that's excellent, because that's precisely what the fatality benefit is for.

What are the advantages of whole life insurance coverage? One of the most appealing advantages of acquiring an entire life insurance plan is this: As long as you pay your costs, your fatality benefit will never ever end.

Assume you do not require life insurance if you do not have youngsters? There are numerous benefits to having life insurance policy, also if you're not supporting a family members.

What is Life Insurance?

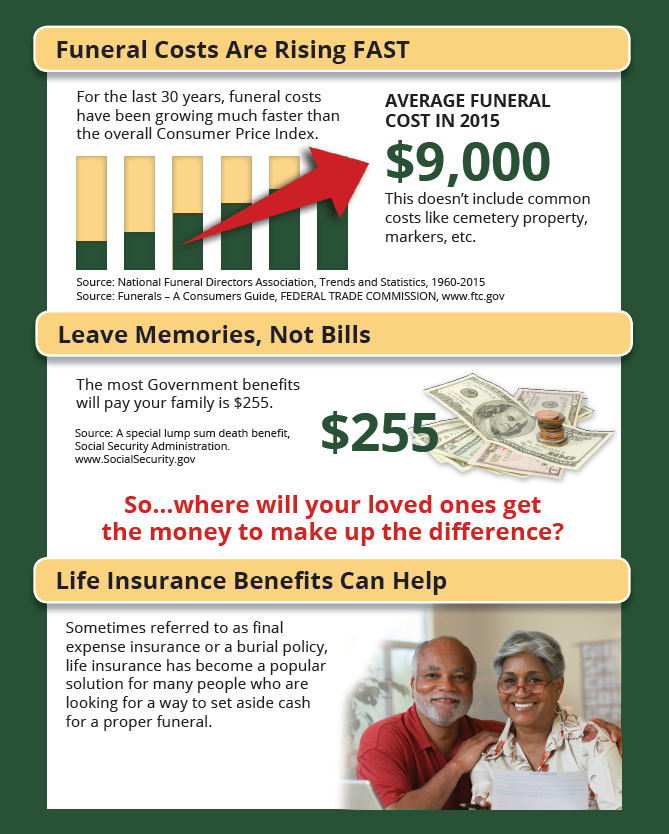

Funeral expenditures, funeral prices and medical costs can include up. Irreversible life insurance coverage is readily available in various quantities, so you can choose a death advantage that fulfills your requirements.

Establish whether term or irreversible life insurance policy is best for you. After that, obtain a quote of how much coverage you might need, and how much it could cost. Locate the correct amount for your budget and tranquility of mind. Find your amount. As your individual circumstances change (i.e., marriage, birth of a child or work promotion), so will certainly your life insurance policy needs.

Generally, there are 2 kinds of life insurance policy intends - either term or irreversible plans or some combination of both. Life insurance companies use different types of term strategies and typical life plans in addition to "rate of interest delicate" items which have become a lot more prevalent given that the 1980's.

Term insurance coverage gives security for a specific time period. This duration could be as short as one year or give insurance coverage for a specific number of years such as 5, 10, two decades or to a defined age such as 80 or sometimes as much as the earliest age in the life insurance policy death tables.

What are the benefits of Protection Plans?

Currently term insurance policy prices are very competitive and amongst the most affordable traditionally seasoned. It needs to be kept in mind that it is an extensively held idea that term insurance coverage is the least expensive pure life insurance policy coverage offered. One requires to evaluate the plan terms carefully to decide which term life choices are suitable to meet your specific situations.

With each new term the costs is raised. The right to renew the plan without evidence of insurability is an important advantage to you. Or else, the threat you take is that your health and wellness might deteriorate and you might be unable to acquire a policy at the very same prices and even in any way, leaving you and your beneficiaries without coverage.

The size of the conversion duration will vary depending on the kind of term plan bought. The premium price you pay on conversion is usually based on your "existing obtained age", which is your age on the conversion day.

Under a level term plan the face quantity of the plan remains the very same for the entire duration. With lowering term the face amount decreases over the period. The costs remains the exact same each year. Typically such policies are marketed as home loan defense with the amount of insurance coverage lowering as the equilibrium of the home mortgage decreases.

How long does Protection Plans coverage last?

Generally, insurance companies have actually not can alter premiums after the policy is offered. Since such policies may proceed for several years, insurance firms should make use of conservative death, interest and expenditure price quotes in the premium estimation. Flexible costs insurance policy, nevertheless, allows insurance firms to provide insurance policy at reduced "current" costs based upon less conventional presumptions with the right to change these premiums in the future.

While term insurance coverage is designed to provide security for a specified amount of time, irreversible insurance is created to offer protection for your entire lifetime. To keep the costs rate degree, the premium at the younger ages surpasses the actual cost of defense. This extra premium constructs a get (cash worth) which helps pay for the policy in later years as the cost of protection increases above the premium.

The insurance company invests the excess premium dollars This kind of plan, which is occasionally called cash value life insurance, creates a savings component. Money worths are crucial to a long-term life insurance coverage plan.

Latest Posts

Pre Need Life Insurance

Life Insurance Policy For Burial Expenses

Instant Life Insurance No Exam