All Categories

Featured

Table of Contents

When individuals say "home loan defense life insurance policy" they often tend to mean this one. With this plan, your cover amount lowers over time to mirror the shrinking sum total you owe on your home loan.

To see if you could conserve money with decreasing term life insurance policy, demand a callback from a LifeSearch expert today. For more details click on this link or visit our mortgage protection insurance policy web page. Yes it does. The point of home loan protection is to cover the expense of your home mortgage if you're not about to pay it.

You can relax very easy that if something happens to you your home loan will certainly be paid. Your enjoyed ones won't have to soak up the worry of what's probably your largest expenses. If you have a household, your fatality doesn't need to risk your household losing their home. Life insurance policy and home mortgage security can be practically one in the exact same.

The swelling amount payment goes to your loved ones, and they may pick not to clear the home loan with it. It depends if you still wish to leave cash for liked ones when you die. If your home loan is clear, you're mostly debt-free, and have no economic dependents, life insurance coverage or health problem cover may feel unnecessary.

If you're home loan totally free, and heading right into old age territory, it deserves looking obtaining guidance. Crucial ailment cover could be appropriate, as might over 50s cover. It depends on the value of your home loan, your age, your health, household dimension, lifestyle, hobbies and scenarios generally. While there are a lot of variables to be accurate in answering this question, you can discover some common instances on our life insurance and home mortgage protection web pages - what is the benefit of mortgage insurance.

Whether you desire to go it alone, or you plan to get guidance at some factor, below's a device to help you with things to think of and how much cover you could require. Life insurance coverage exists to secure you. And no 2 people coincide. The most effective plan for you depends upon where you are, what's going on in your home, your health and wellness, your plans, your demands and your spending plan.

Do I Have To Have Mortgage Insurance

This means that every one of the staying home mortgage at the time of the death can be completely repaid. The inexpensive is due to the payout and obligation to the insurance policy company decreasing with time (should i purchase mortgage life insurance). In the very early years, when the fatality payout would certainly be greatest, you are generally much healthier and much less likely to die

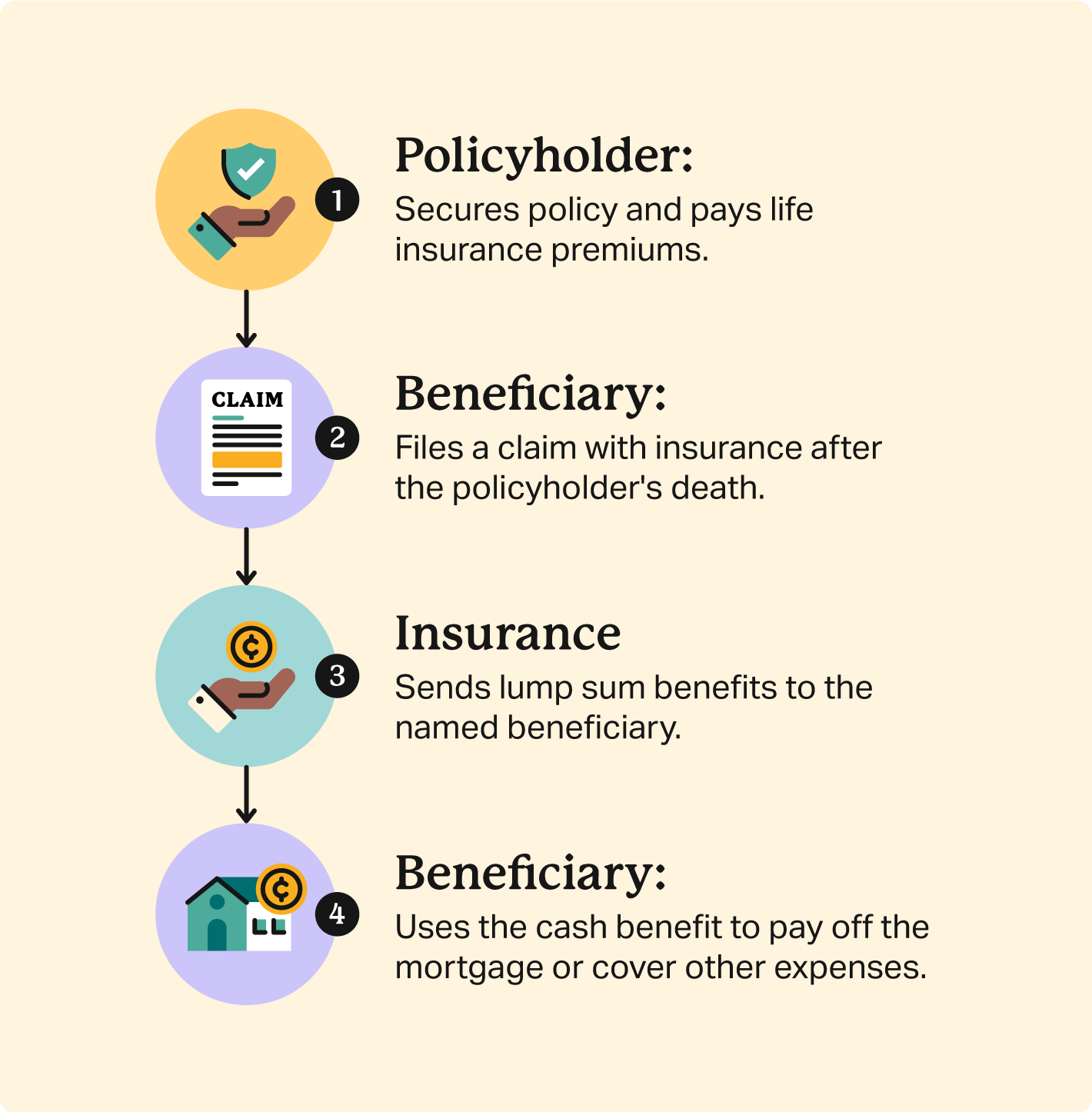

The advantages are paid by the insurance provider to either the estate or to the beneficiaries of the person who has actually passed away. The 'estate' is every little thing they had and leave when they pass away. The 'recipients' are those entitled to a person's estate, whether a Will has actually been left or otherwise.

They can then remain to stay in the home without additional mortgage repayments. Plans can likewise be prepared in joint names and would certainly then pay on the initial death during the home loan term. The advantage would go right to the surviving companion, not the estate of the deceased individual.

What Is Property Mortgage Insurance

The plan would then pay out the amount guaranteed upon medical diagnosis of the strategy holder enduring a significant disease. These include heart strikes, cancer cells, a stroke, kidney failure, heart bypass surgical treatment, coma, overall permanent special needs and a variety of various other significant conditions. Regular monthly premiums are typically fixed from start for the life of the strategy.

The premiums can be impacted by bad wellness, lifestyle factors (e.g. smoking or being obese) and line of work or pastimes. The rate of interest to be billed on the home mortgage is also crucial. The plans usually ensure to pay off the exceptional quantity as long as a certain rates of interest is not exceeded during the life of the funding.

Mortgage defense plans can provide straightforward defense in situation of premature fatality or crucial disease for the superior home loan amount. This is usually most people's biggest month-to-month monetary expenditure (lenders mortgage insurance policy). However, they need to not be thought about as adequate defense for every one of your scenarios, and various other kinds of cover might additionally be needed.

We will certainly assess your insurance needs as part of the home mortgage advice process. We can after that make suggestions to fulfill your demands and your allocate life cover.

Acquisition a term life insurance plan for at the very least the amount of your home mortgage. They can use the profits to pay off the home loan.

Loan Protection Plan Insurance

If your home mortgage has a reduced rates of interest, they might intend to pay off high-interest charge card financial debt and maintain the lower-interest home loan. Or they might intend to pay for home maintenance and maintenance. Whatever they choose to do, that cash will come in useful. Utilize our life insurance policy device. aa mortgage protection insurance to help you obtain an estimate of the quantity of protection you might need, and just how a lot a home mortgage life insurance coverage quote could cost.

Figure out various other manner ins which life insurance policy can assist protect your and your family members.

Approval is guaranteed, no matter of health if you are in between the ages of 18 and 69. No health and wellness questions or medical examinations. The cost effective month-to-month costs will never ever raise for any reason. Rates as reduced as $5.50 per month. For every single year the Plan remains continually active, main insured's Principal Advantage will immediately be enhanced by 5% of the First Principal Advantage till the Principal Advantage is equivalent to 125% of the First Principal Advantage, or the primary insured turns age 70, whichever is previously. loan insurance premium.

Cheapest Mortgage Protection Insurance

World Life is rated A (Outstanding)**by A.M.

For most peopleA lot of term life insurance offers insurance coverage robust a lot more durable Insurance coverage and can also be additionally to pay off your mortgage in the event of your death. Home mortgage life insurance policy is designed to cover the balance on your home mortgage if you die before paying it in full. The payment from the plan reduces over time as your home mortgage balance goes down.

The fatality benefit from an MPI goes right to your home loan loan provider, not your family, so they wouldn't be able to utilize the payout for any various other debts or bills. There are cheaper alternatives offered.

Mortgage Protection Insurance License

The fatality advantage: Your MPI survivor benefit lowers as you settle your home loan, while term life plans most typically have a level fatality advantage. This indicates that the coverage quantity of term life insurance policy remains the very same for the whole period policy. Mortgage security insurance coverage is commonly puzzled with private mortgage insurance (PMI).

Nevertheless, entire life is significantly extra costly than term life. "Term life is extremely essential for any specific they can have university finances, they may be married and have kids, they may be solitary and have charge card loans," Ruiz said. "Term life insurance policy makes good sense for the majority of people, but some people desire both" term life and entire life coverage.

Otherwise, a term life insurance coverage policy likely will offer even more flexibility at a less costly expense."If you're not certain which type of life insurance is best for your scenario, talking with an independent broker can aid.

The only standard "exclusion" is for suicide within the initial 13 months of setting up the plan. Like life insurance policy, home loan defense is pretty simple.

Latest Posts

Pre Need Life Insurance

Life Insurance Policy For Burial Expenses

Instant Life Insurance No Exam