All Categories

Featured

Table of Contents

Right here are some sorts of non-traditional living benefits motorcyclists: If the insurance policy holder outlives the regard to their term life insurance policy, the return of premium motorcyclist makes sure that all or part of the costs paid are gone back to the insurance policy holder. This can interest those who desire the assurance of obtaining their refund if the plan is never ever utilized.

The insurer will certainly either cover the premiums or waive them.: The ensured insurability motorcyclist allows the insurance holder to purchase extra coverage at details intervals without verifying insurability. Valuable for those who prepare for requiring extra protection in the future, especially important for younger insurance policy holders whose demands might boost with life events like marital relationship or childbirth.

What is the best Riders option?

Providing monetary relief throughout the uncomfortable event of a child's death, covering funeral expenses, and permitting time off work.

As opposed to concentrating on assisted living facility or helped living facilities, the Home Healthcare Cyclist offers benefits if the insured calls for home healthcare solutions. Allows people to receive care in the comfort of their own homes. In instance of a separation, the Divorce Protection Biker allows for modifications in plan possession or recipient designations without needing the permission of the initially named plan proprietor or recipient.

If the policyholder ends up being involuntarily out of work, this cyclist waives the premiums for a given period. Guarantees the plan does not gap during periods of monetary hardship because of unemployment. It is necessary to understand the terms of each motorcyclist. The price, benefit quantity, duration, and specific triggers vary commonly among insurance carriers.

Not everybody is automatically qualified for life insurance policy living advantage plan cyclists. The details eligibility requirements can depend on several factors, consisting of the insurance provider's underwriting guidelines, the kind and term of the plan, and the certain motorcyclist requested. Below are some typical factors that insurance companies may think about:: Just specific sorts of life insurance plans might provide living advantages riders or have them consisted of as common functions.

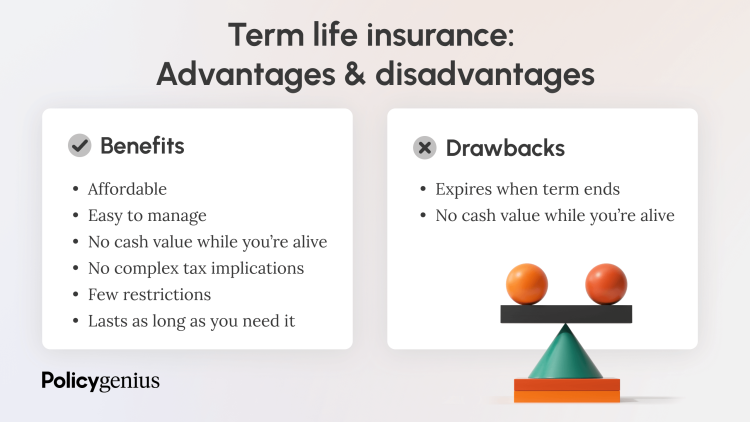

Is Term Life Insurance worth it?

: Many insurer have age constraints when adding or exercising living benefits riders. An essential ailment rider could be offered only to policyholders below a specific age, such as 65.: First eligibility can be affected by the insured's health status. Some pre-existing conditions may make it challenging to get certain bikers, or they could result in greater premiums.

:: An insurance holder might require to be diagnosed with one of the covered critical illnesses.: The insured could have to verify they can not carry out a set number of Activities of Daily Living (ADLs) - Wealth transfer plans.: A physician normally need to detect the policyholder with a terminal disease, having actually a specified time (e.g., twelve month) to live

What is the process for getting Whole Life Insurance?

A return of premium rider on a term plan could only be available if the policyholder outlives the entire term.: For certain cyclists, particularly those associated to health, like the important ailment rider, extra underwriting could be required. This can involve clinical examinations or in-depth wellness questionnaires.

While life insurance policy with living benefits provides an included layer of security and adaptability, it's critical to be mindful of potential disadvantages to make a well-informed decision. Below are some prospective drawbacks to take into consideration:: Accessing living benefits typically means that the fatality benefit is minimized by the quantity you withdraw.

What is the best Wealth Transfer Plans option?

: Adding living advantages motorcyclists to a plan might cause higher premiums than a conventional plan without such riders.: There may be caps on the amount you can take out under living benefits. Some plans could limit you to 50% or 75% of the fatality benefit - Mortgage protection.: Living benefits can introduce extra complexity to the policy.

While giving an exact buck amount without certain details is challenging, right here are the typical variables and factors to consider that influence the price. Life insurance policy firms value their products in a different way based upon their underwriting standards and risk assessment models. Age, health and wellness, way of life, line of work, life expectations, and whether or not you smoke can all influence the price of a life insurance costs, and this lugs over right into the rate of a rider.

Whether living benefit riders are worth it relies on your conditions, monetary objectives, and danger tolerance. They can be a valuable enhancement for some people, however the extra expense may not be warranted for others. Below are a couple of factors to consider to assist establish if it may be best for you:: If your family has a substantial background of ailments, an essential illness motorcyclist may make more sense for you.

One of the advantages of being guaranteed is that you make arrangements to put your life insurance in to a depend on. This offers you better control over that will gain from your plan (the beneficiaries). You assign trustees to hold the money amount from your plan, they will have discernment regarding which among the beneficiaries to pass it on t, just how much each will certainly get and when.

What happens if I don’t have Living Benefits?

Learn more regarding life insurance policy and tax. It is very important to keep in mind that life insurance is not a savings or investment plan and has no cash worth unless a legitimate claim is made.

If you die while you are an active member, your recipient or relative should call your company. The company will assist in working with any type of benefits that may be due. If you die while you are retired, your beneficiary or survivor ought to call Securian Financial toll-free at 800-441-2258. VRS has contracted with Securian Financial as the insurance company for the Group Life Insurance Coverage Program.

If you were covered under the VRS Team Life Insurance Policy Program as a participant, some advantages continue into retirement, or if you are qualified to retire however postpone retirement. Your insurance coverage will end if you do not satisfy the age and service requirements for retirement or you take a reimbursement of your member contributions and interest.

The decrease price is 25% each January 1 up until it reaches 25% of the total life insurance benefit worth at retired life. If you have at least three decades of service credit history, your protection can not minimize below $9,532. This minimum will certainly be raised annually based on the VRS Strategy 2 cost-of-living modification calculation.

What should I know before getting Retirement Planning?

On January 1, 2028, your life insurance policy coverage decreases to $50,000. On January 1 following 3 schedule years after your employment ends (January with December), your life insurance policy protection minimizes a final 25% and remains at that value for the remainder of your retired life. Your final decrease will certainly get on January 1, 2029, and your insurance coverage will remain at $25,000 * for the remainder of your retired life.

Latest Posts

Pre Need Life Insurance

Life Insurance Policy For Burial Expenses

Instant Life Insurance No Exam