All Categories

Featured

Table of Contents

Premiums are normally lower than entire life plans. With a degree term policy, you can choose your protection quantity and the policy size.

And you can't pay out your plan throughout its term, so you won't receive any economic benefit from your previous coverage. As with various other sorts of life insurance, the expense of a level term plan depends upon your age, coverage requirements, work, way of living and wellness. Normally, you'll discover a lot more economical coverage if you're younger, healthier and much less risky to insure.

Given that level term premiums remain the exact same for the period of insurance coverage, you'll recognize specifically just how much you'll pay each time. Level term insurance coverage also has some adaptability, permitting you to personalize your plan with additional attributes.

You may have to satisfy details problems and certifications for your insurance firm to pass this biker. There additionally can be an age or time restriction on the protection.

Where can I find Best Level Term Life Insurance?

The fatality advantage is typically smaller sized, and coverage usually lasts till your kid transforms 18 or 25. This motorcyclist may be an extra cost-efficient way to assist guarantee your kids are covered as riders can commonly cover numerous dependents at the same time. When your child ages out of this protection, it might be feasible to transform the motorcyclist into a brand-new policy.

When contrasting term versus long-term life insurance coverage, it is very important to keep in mind there are a few different types. The most usual type of permanent life insurance policy is entire life insurance policy, yet it has some crucial differences contrasted to level term coverage. Here's a standard overview of what to think about when comparing term vs.

Whole life insurance policy lasts forever, while term protection lasts for a particular period. The costs for term life insurance policy are normally lower than entire life protection. Nevertheless, with both, the premiums stay the same for the period of the policy. Entire life insurance policy has a cash worth element, where a part of the premium might expand tax-deferred for future requirements.

Where can I find Guaranteed Level Term Life Insurance?

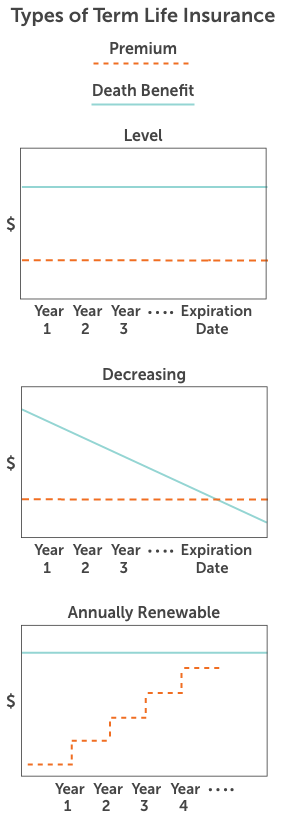

One of the primary attributes of level term insurance coverage is that your costs and your survivor benefit don't transform. With lowering term life insurance policy, your premiums stay the very same; nonetheless, the survivor benefit amount obtains smaller sized with time. As an example, you might have coverage that starts with a death benefit of $10,000, which can cover a home mortgage, and after that annually, the survivor benefit will certainly lower by a collection quantity or percent.

Because of this, it's frequently a much more budget-friendly type of level term insurance coverage. You may have life insurance policy with your company, however it may not be enough life insurance coverage for your demands. The first step when getting a plan is determining just how much life insurance you require. Consider factors such as: Age Family members dimension and ages Work standing Income Debt Way of living Expected last expenses A life insurance policy calculator can help figure out exactly how much you require to begin.

After choosing a plan, complete the application. For the underwriting process, you might have to provide general individual, wellness, way of living and employment info. Your insurance firm will certainly figure out if you are insurable and the threat you may present to them, which is shown in your premium prices. If you're accepted, sign the documents and pay your initial premium.

Ultimately, consider organizing time yearly to review your plan. You might intend to update your beneficiary info if you have actually had any type of considerable life changes, such as a marital relationship, birth or divorce. Life insurance policy can often feel complicated. But you don't need to go it alone. As you discover your options, think about discussing your demands, desires and worries with a monetary professional.

Compare Level Term Life Insurance

No, level term life insurance coverage doesn't have money value. Some life insurance policies have an investment attribute that allows you to develop cash value in time. Level term life insurance calculator. A part of your costs settlements is reserved and can earn passion gradually, which grows tax-deferred during the life of your insurance coverage

These plans are commonly considerably a lot more costly than term insurance coverage. You can: If you're 65 and your coverage has actually run out, for instance, you may desire to get a new 10-year level term life insurance plan.

What is the process for getting Level Term Life Insurance Protection?

You may be able to convert your term coverage into a whole life plan that will certainly last for the rest of your life. Numerous kinds of degree term plans are exchangeable. That indicates, at the end of your protection, you can transform some or all of your policy to whole life protection.

Degree term life insurance policy is a policy that lasts a collection term generally between 10 and 30 years and includes a degree death benefit and degree costs that remain the same for the entire time the policy holds. This means you'll recognize exactly just how much your settlements are and when you'll need to make them, enabling you to spending plan as necessary.

Level term can be a wonderful choice if you're aiming to get life insurance policy coverage for the initial time. According to LIMRA's 2023 Insurance coverage Measure Research Study, 30% of all grownups in the U.S. requirement life insurance policy and do not have any type of sort of policy yet. Degree term life is predictable and budget friendly, that makes it one of the most prominent sorts of life insurance

A 30-year-old man with a similar account can anticipate to pay $29 per month for the same coverage. AgeGender$250,000 coverage amount$500,000 protection amount$1 million protection amount20Female$15$23$34Male$19$29$4830Female$15$23$37Male$18$29$4940Female$22$35$61Male$25$43$7550Female$44$78$139Male$57$102$18860Female$108$194$355Male$149$268$500 Collapse table Methodology: Ordinary regular monthly rates are computed for male and women non-smokers in a Preferred health category obtaining a 20-year $250,000, $500,000, or $1,000,000 term life insurance policy plan.

Level Term Life Insurance Policy Options

Rates might differ by insurance provider, term, insurance coverage amount, wellness course, and state. Not all plans are available in all states. It's the cheapest kind of life insurance policy for most individuals.

It enables you to budget and prepare for the future. You can conveniently factor your life insurance policy right into your budget plan due to the fact that the premiums never transform. You can prepare for the future simply as quickly since you recognize specifically how much cash your loved ones will receive in the occasion of your lack.

How do I apply for Level Term Life Insurance Protection?

In these situations, you'll generally have to go with a new application procedure to obtain a far better price. If you still need insurance coverage by the time your level term life policy nears the expiry day, you have a few options.

Latest Posts

Pre Need Life Insurance

Life Insurance Policy For Burial Expenses

Instant Life Insurance No Exam