All Categories

Featured

Table of Contents

- – What is the Role of Term Life Insurance With A...

- – What is Voluntary Term Life Insurance? What Yo...

- – What is Level Term Vs Decreasing Term Life In...

- – What Exactly is Level Premium Term Life Insur...

- – What is Direct Term Life Insurance Meaning? ...

- – What is Direct Term Life Insurance Meaning? ...

- – How Does Simplified Term Life Insurance Work...

With this kind of level term insurance coverage policy, you pay the very same regular monthly costs, and your beneficiary or beneficiaries would certainly obtain the same advantage in the event of your death, for the entire coverage duration of the plan. How does life insurance coverage job in terms of price? The cost of level term life insurance policy will depend upon your age and health in addition to the term size and protection quantity you choose.

Life: AgeGenderFace AmountTerm LengthPremium30Male$500,00030$29.9930 Woman$1,000,00030$43.3135 Man$500,00020$20.7235 Female$750,00020$23.1340 Male$600,00015$22.8440 Woman$800,00015$27.72 Price quote based on rates for qualified Sanctuary Simple applicants in excellent wellness. Prices distinctions will differ based upon ages, wellness condition, insurance coverage quantity and term size. Place Simple is presently not offered in DE, ND, NY, and SD. Regardless of what insurance coverage you choose, what the policy's money worth is, or what the round figure of the fatality advantage becomes, assurance is among the most valuable advantages connected with acquiring a life insurance coverage policy.

Why would certainly a person pick a plan with a yearly eco-friendly premium? It might be an alternative to think about for a person that requires protection just temporarily.

What is the Role of Term Life Insurance With Accidental Death Benefit?

You can typically renew the plan yearly which provides you time to consider your alternatives if you want coverage for longer. Realize that those choices will involve paying greater than you used to. As you age, life insurance coverage costs end up being considerably much more costly. That's why it's valuable to buy the correct amount and length of insurance coverage when you first get life insurance policy, so you can have a reduced price while you're young and healthy and balanced.

If you contribute important overdue labor to the house, such as child treatment, ask on your own what it might set you back to cover that caretaking work if you were no more there. Then, make sure you have that insurance coverage in position so that your household obtains the life insurance coverage benefit that they need.

What is Voluntary Term Life Insurance? What You Should Know?

For that set amount of time, as long as you pay your premium, your price is steady and your beneficiaries are shielded. Does that imply you should constantly select a 30-year term length? Not necessarily. Generally, a shorter term plan has a lower costs price than a longer policy, so it's clever to select a term based on the projected length of your monetary duties.

These are very important variables to bear in mind if you were thinking concerning selecting a long-term life insurance policy such as an entire life insurance policy plan. Several life insurance policy plans give you the option to add life insurance coverage cyclists, assume added benefits, to your policy. Some life insurance plans come with cyclists integrated to the expense of premium, or riders may be available at a price, or have charges when exercised.

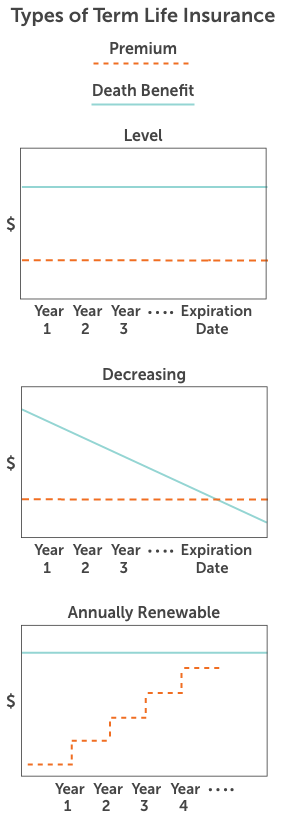

What is Level Term Vs Decreasing Term Life Insurance? Detailed Insights?

With term life insurance policy, the interaction that most individuals have with their life insurance policy business is a month-to-month expense for 10 to thirty years. You pay your month-to-month costs and hope your household will never ever need to use it. For the team at Haven Life, that appeared like a missed out on possibility.

Our team believe browsing decisions about life insurance coverage, your individual funds and overall health can be refreshingly basic (Term life insurance with accelerated death benefit). Our material is developed for educational functions only. Haven Life does not endorse the companies, products, solutions or strategies discussed below, however we hope they can make your life a little much less hard if they are a fit for your situation

This material is not meant to provide, and need to not be depended on for tax, lawful, or investment suggestions. People are urged to seed guidance from their own tax obligation or legal counsel. Learn More Sanctuary Term is a Term Life Insurance Policy Policy (DTC and ICC17DTC in particular states, consisting of NC) issued by Massachusetts Mutual Life Insurance Policy Business (MassMutual), Springfield, MA 01111-0001 and supplied specifically through Place Life insurance policy Firm, LLC.

Finest Firm as A++ (Superior; Top classification of 15). The score is since Aril 1, 2020 and goes through transform. MassMutual has actually obtained different ratings from various other score agencies. Haven Life Plus (And Also) is the advertising and marketing name for the And also biker, which is included as component of the Sanctuary Term plan and offers accessibility to added solutions and benefits at no charge or at a discount rate.

What Exactly is Level Premium Term Life Insurance Policies Policy?

Learn much more in this guide. If you depend upon somebody monetarily, you could question if they have a life insurance coverage policy. Discover how to find out.newsletter-msg-success,. newsletter-msg-error screen: none;.

When you're more youthful, term life insurance policy can be a simple way to shield your liked ones. As life adjustments your financial priorities can also, so you may want to have entire life insurance for its lifetime protection and extra benefits that you can utilize while you're living. That's where a term conversion comes in.

What is Direct Term Life Insurance Meaning? A Simple Explanation?

Approval is guaranteed no matter your health. The premiums won't increase when they're established, yet they will increase with age, so it's an excellent concept to secure them in early. Discover a lot more concerning how a term conversion works.

Words "level" in the expression "level term insurance" implies that this type of insurance coverage has a set premium and face quantity (death benefit) throughout the life of the plan. Just placed, when individuals speak about term life insurance, they commonly describe level term life insurance policy. For most of individuals, it is the easiest and most economical selection of all life insurance kinds.

What is Direct Term Life Insurance Meaning? How to Choose the Right Policy?

Words "term" right here describes a provided variety of years throughout which the level term life insurance policy remains active. Level term life insurance is among the most preferred life insurance policy plans that life insurance service providers offer to their customers as a result of its simpleness and price. It is likewise simple to compare level term life insurance policy quotes and obtain the best premiums.

The device is as complies with: Firstly, pick a policy, death advantage quantity and policy period (or term length). Secondly, pick to pay on either a regular monthly or annual basis. If your early death happens within the life of the policy, your life insurance firm will certainly pay a round figure of survivor benefit to your determined beneficiaries.

How Does Simplified Term Life Insurance Work for Families?

Your level term life insurance coverage policy ends when you come to the end of your policy's term. Alternative B: Get a brand-new degree term life insurance coverage policy.

1 Life Insurance Policy Stats, Information And Sector Trends 2024. 2 Expense of insurance rates are determined using methodologies that differ by company. These prices can differ and will generally boost with age. Rates for active staff members might be various than those readily available to terminated or retired staff members. It's crucial to check out all elements when reviewing the overall competition of prices and the worth of life insurance coverage.

Table of Contents

- – What is the Role of Term Life Insurance With A...

- – What is Voluntary Term Life Insurance? What Yo...

- – What is Level Term Vs Decreasing Term Life In...

- – What Exactly is Level Premium Term Life Insur...

- – What is Direct Term Life Insurance Meaning? ...

- – What is Direct Term Life Insurance Meaning? ...

- – How Does Simplified Term Life Insurance Work...

Latest Posts

Pre Need Life Insurance

Life Insurance Policy For Burial Expenses

Instant Life Insurance No Exam

More

Latest Posts

Pre Need Life Insurance

Life Insurance Policy For Burial Expenses

Instant Life Insurance No Exam