All Categories

Featured

Table of Contents

Juvenile insurance policy offers a minimum of protection and could offer insurance coverage, which may not be offered at a later date. Amounts offered under such protection are normally minimal based upon the age of the kid. The present limitations for minors under the age of 14.5 would be the higher of $50,000 or 50% of the quantity of life insurance in force upon the life of the applicant.

Juvenile insurance coverage may be marketed with a payor benefit cyclist, which offers forgoing future premiums on the youngster's plan in case of the fatality of the person that pays the costs. Elderly life insurance coverage, sometimes referred to as rated survivor benefit strategies, gives eligible older candidates with minimal entire life protection without a clinical exam.

The allowable concern ages for this type of coverage array from ages 50 75. The optimum problem amount of coverage is $25,000. These policies are generally extra expensive than a fully underwritten policy if the person certifies as a typical threat. This kind of coverage is for a tiny face amount, usually bought to pay the interment expenses of the insured.

Our term life choices include 10, 15, 20, 25, 30, 35, and 40-year policies. One of the most preferred type is level term, indicating your settlement (premium) and payment (survivor benefit) remains level, or the same, till the end of the term duration. This is one of the most simple of life insurance policy choices and needs really little maintenance for plan proprietors.

What is Compare Level Term Life Insurance?

You might give 50% to your partner and divided the remainder among your grown-up kids, a moms and dad, a good friend, or also a charity. Level premium term life insurance. * In some circumstances the death advantage may not be tax-free, learn when life insurance policy is taxed

1Term life insurance policy supplies momentary security for a vital period of time and is generally less costly than irreversible life insurance policy. 2Term conversion guidelines and limitations, such as timing, might apply; as an example, there might be a ten-year conversion privilege for some products and a five-year conversion advantage for others.

3Rider Insured's Paid-Up Insurance policy Acquisition Alternative in New York. There is a price to exercise this biker. Not all getting involved policy owners are qualified for dividends.

How much does What Is Level Term Life Insurance? cost?

We may be made up if you click this ad. Whether you die on the very same day you take out a policy or the last, your recipients will certainly receive the very same payout.

Which one you choose depends on your needs and whether or not the insurance provider will certainly authorize it. Policies can likewise last until specified ages, which most of the times are 65. As a result of the many terms it offers, degree life insurance offers prospective insurance holders with versatile choices. Past this surface-level details, having a higher understanding of what these plans entail will assist ensure you buy a plan that fulfills your requirements.

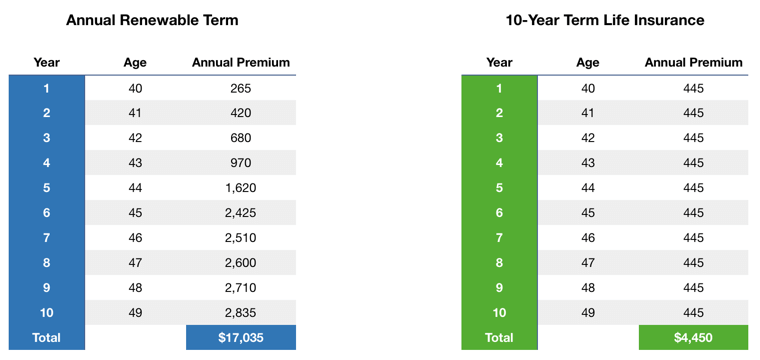

Be conscious that the term you choose will affect the costs you pay for the plan. A 10-year level term life insurance coverage plan will certainly set you back much less than a 30-year policy since there's less possibility of a case while the plan is energetic. Lower threat for the insurance provider equates to lower premiums for the policyholder.

How do I cancel Level Term Life Insurance Companies?

Your family members's age ought to likewise influence your plan term selection. If you have children, a longer term makes good sense due to the fact that it safeguards them for a longer time. Nevertheless, if your youngsters are near their adult years and will certainly be economically independent in the near future, a shorter term could be a far better suitable for you than an extensive one.

Nevertheless, when contrasting whole life insurance policy vs. term life insurance policy, it's worth noting that the last usually expenses much less than the former. The result is more coverage with lower premiums, providing the very best of both worlds if you require a considerable quantity of coverage yet can not pay for a much more pricey plan.

How long does Level Term Life Insurance Quotes coverage last?

A level survivor benefit for a term plan typically pays out as a swelling sum. When that occurs, your heirs will certainly receive the whole quantity in a single settlement, and that amount is not considered revenue by the IRS. Those life insurance coverage profits aren't taxable. Level term life insurance protection. Nevertheless, some level term life insurance policy firms permit fixed-period payments.

Rate of interest payments received from life insurance policies are taken into consideration earnings and are subject to taxation. When your degree term life plan expires, a couple of different points can take place.

The disadvantage is that your sustainable degree term life insurance coverage will certainly come with greater premiums after its initial expiration. Advertisements by Money. We may be made up if you click this ad. Ad For beginners, life insurance policy can be complicated and you'll have concerns you desire responded to before dedicating to any type of plan.

How do I compare Level Term Life Insurance Benefits plans?

Life insurance policy firms have a formula for calculating threat using mortality and rate of interest. Insurance companies have hundreds of clients obtaining term life policies at as soon as and utilize the premiums from its active plans to pay enduring beneficiaries of various other policies. These companies utilize death tables to approximate the number of individuals within a particular team will certainly file death claims annually, which information is used to determine typical life expectations for prospective policyholders.

In addition, insurance coverage companies can spend the cash they receive from costs and raise their revenue. The insurance company can spend the money and make returns - Level term life insurance benefits.

The complying with area information the pros and cons of level term life insurance policy. Foreseeable costs and life insurance policy coverage Simplified policy structure Prospective for conversion to irreversible life insurance policy Limited coverage period No cash worth build-up Life insurance policy costs can boost after the term You'll locate clear advantages when contrasting level term life insurance coverage to various other insurance policy kinds.

How do I apply for Level Term Life Insurance Policy Options?

From the minute you take out a policy, your premiums will certainly never change, assisting you intend financially. Your protection will not vary either, making these plans reliable for estate planning.

If you go this route, your premiums will certainly boost yet it's always great to have some flexibility if you desire to maintain an energetic life insurance plan. Renewable degree term life insurance policy is an additional alternative worth taking into consideration. These plans allow you to keep your existing plan after expiry, offering flexibility in the future.

Latest Posts

Pre Need Life Insurance

Life Insurance Policy For Burial Expenses

Instant Life Insurance No Exam